toneeees

Administrator

- Joined

- Mar 15, 2011

- Messages

- 3,024

[FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]![engineShutdownAnimation[1].gif engineShutdownAnimation[1].gif](https://forums.iboats.com/data/attachments/196/196637-c44f6274835fd70528e18594ee3ab029.jpg) [/FONT]

[/FONT]

[FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]Contrary to what most people believe, boat insurance is a wide-ranging market. Because of the complicated risk inherent in owning and operating a boat, coverage options and insurance rates can vary significantly from one company to the next. Navigation area, storage location, ownership experience, claim history, and motor vehicle record are all examples of variables that help determine your coverage needs. More specifically, each company uses its own combination of these factors to calculate whether you are high or low risk.[/FONT]

[FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]To ensure you are getting the maximum amount of savings on your boat insurance, it is important that you understand how these variables can affect you and more importantly, what to ask for when receiving a quote. The following is a list of variable discounts that could be applied to your policy:[/FONT]

As always, our main priority is educating our boat owners. For a free, no-hassle quote, speak directly to one of our agents at 1-800-248-3512 or submit your quote online at www.nboat.com.

[FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif] NBOA Marine Insurance attends hundreds of boat shows across the country. We are there to help new boat buyers obtain insurance, answer any insurance questions, or counsel potential customers on how to work insurance costs into their budget. If you see us this upcoming boat show season, be sure to stop by our booth and say hello! As always, if you have any questions or would like a quote please call us directly at 1-800-248-3512 or visit nboat.com.[/FONT]

NBOA Marine Insurance attends hundreds of boat shows across the country. We are there to help new boat buyers obtain insurance, answer any insurance questions, or counsel potential customers on how to work insurance costs into their budget. If you see us this upcoming boat show season, be sure to stop by our booth and say hello! As always, if you have any questions or would like a quote please call us directly at 1-800-248-3512 or visit nboat.com.[/FONT]

![engineShutdownAnimation[1].gif engineShutdownAnimation[1].gif](https://forums.iboats.com/data/attachments/196/196637-c44f6274835fd70528e18594ee3ab029.jpg) [/FONT]

[/FONT][FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]Contrary to what most people believe, boat insurance is a wide-ranging market. Because of the complicated risk inherent in owning and operating a boat, coverage options and insurance rates can vary significantly from one company to the next. Navigation area, storage location, ownership experience, claim history, and motor vehicle record are all examples of variables that help determine your coverage needs. More specifically, each company uses its own combination of these factors to calculate whether you are high or low risk.[/FONT]

[FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]To ensure you are getting the maximum amount of savings on your boat insurance, it is important that you understand how these variables can affect you and more importantly, what to ask for when receiving a quote. The following is a list of variable discounts that could be applied to your policy:[/FONT]

- [FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]Automatic Fire Extinguisher System - Attain a discount with prevention systems. Installing an automatic fire suppression system can help you save on your annual premium.[/FONT]

- [FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]Additional Safety Equipment - Having additional safety equipment such as EPIRBs, GPS systems, Depth Finders, Carbon Monoxide Detectors, or Radar on board can help you save as well.[/FONT]

- [FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]Boating Education Course - If you hold a current boating safety course certificate from the US Power Squadron or the USCG Auxiliary, you are entitled to a five or ten percent discount. Discounts also apply to state courses, as long as it's approved by the National Association of State Boating Law Administrators (NASBLA) and recognized by the US Coast Guard.[/FONT]

- Boat Currently Insured - If your boat is currently insured, some companies will give you a credit for keeping it protected.

- Choice of Coverage - Opting for higher limits of coverage, such as higher liability coverage, will increase your rate. In contrast, choosing a high deductible will lower your rate.

- Clean Driving Record - Safely operating an automobile translates into safely operating a boat. The ability to drive responsibly renders another potential discount.

- Diesel Engines - If your boat is powered by diesel, you could save on the cost of your Physical Damage coverage.

- Insurance Score - Using credit history to determine appropriate insurance rates is becoming increasingly popular with insurance companies. By performing a "soft hit" credit score, insurance companies can view credit history without actually affecting the prospect's credit. In theory, two owners with the same boat in the same area can have dramatically different premiums if their credit scores are different.

- Marital Status - Having a spouse is a positive factor for some companies and therefore results in a cheaper rate. But singles do not fret. There are certain insurance companies that do not take your marital status into account at all.

- Multi-Policy Discount - When including your boat with your homeowners and/or auto policy, many companies offer an additional credit for insuring multi-lines. Although a popular option, one thing to keep in mind is that multi-line companies are not likely specialized in boat insurance. Discount aside, you may miss out on other benefits with an agent who is unfamiliar with boats.

- Navigation - Where you plan to use your boat greatly affects your insurance rate. If you live in coastal regions like Florida, you are well aware of this stipulation. Areas with coastal exposure are considered high risk and therefore have higher rates. Since inland boaters are considered low risk insurers, lower rates apply.

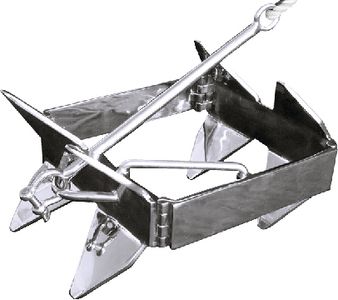

![CMD-1MR-9V[1].gif CMD-1MR-9V[1].gif](https://forums.iboats.com/data/attachments/196/196638-685c15baae7462215392f72e2c6adfcd.jpg)

Navigation limits are another variable that varies from company to company; size and power of the boat is also a factor. Some companies use very broad navigation limits such as Inland and Coastal Regions of the United States, while others have very specific limits. A separate one-trip or yearly "rider" can also be applied for those wishing to temporarily extend their navigation limits and travel to places such as the Bahamas and Mexico. - New Boat Discount - Your new expense can actually save you money. The newer the boat, the higher the discount.

- No Prior Claims - Having a safe boating record is also important in getting the best possible rate. Some companies do not differentiate at-fault and no-fault claims, so be sure to ask your agent to point out which companies do.

- Outboard Motors - Because they are easier to maintain and repair, outboard motors generally warrant discounts. This does, however, depend on the number of motors.

- Owner's Age - Who says getting old doesn't have its advantages? With boat insurance, the older you are the better your rate!

- Owning a Home - Home ownership can also be a positive factor and result in lower rates.

- Previous Boats Owned - Being able to operate a 20 foot bow rider does not mean you can safely operate a 45 foot yacht. All boating experience aside, many companies actually require comparable boat ownership history before insuring your newest vessel. This is particularly applicable with larger vessels.

- Speed of Vessel - While many companies surcharge or refuse to insure a boat that is too fast, others may give a credit for boats with the maximum speed of 25 to 35 mph.

- Years of Boating Experience - Along with age, the years of actual boating experience you have can have a positive effect on your rate.

As always, our main priority is educating our boat owners. For a free, no-hassle quote, speak directly to one of our agents at 1-800-248-3512 or submit your quote online at www.nboat.com.

[FONT=Trebuchet MS, Lucida Grande, Arial, sans-serif]

NBOA Marine Insurance attends hundreds of boat shows across the country. We are there to help new boat buyers obtain insurance, answer any insurance questions, or counsel potential customers on how to work insurance costs into their budget. If you see us this upcoming boat show season, be sure to stop by our booth and say hello! As always, if you have any questions or would like a quote please call us directly at 1-800-248-3512 or visit nboat.com.[/FONT]

NBOA Marine Insurance attends hundreds of boat shows across the country. We are there to help new boat buyers obtain insurance, answer any insurance questions, or counsel potential customers on how to work insurance costs into their budget. If you see us this upcoming boat show season, be sure to stop by our booth and say hello! As always, if you have any questions or would like a quote please call us directly at 1-800-248-3512 or visit nboat.com.[/FONT]

Last edited: