Re: Interesting Comparison of motor size vs fuel consumption

jims123 said:

sell it for more than I paid for it. So, depreciation is nonexistant.

For example, my 30 year old "land yacht" (my towcar) that I bought new in 1980 was just appraised at 25% more than I paid for it. The appraiser even offered to buy it.

Wasn't going to say anything, but what the heck, maybe it'll help somebody.

Hopefully you have a better understanding of depreciation than what comes across above. If you really think selling something today for 25% more than what you paid for it in 1980 means that it hasn't depreciated, you have given away a lot of money over the years.

As commonly used, depreciation is the reduction in value of an asset

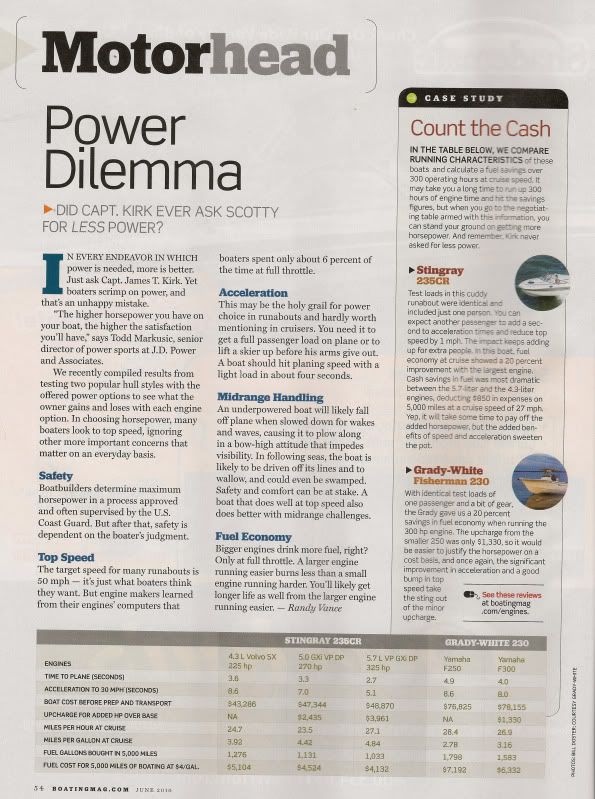

over time. The value of money does not stay constant over time! To calculate depreciation in real dollars you need to consider the

time value of money. Inflation since 1980 has been 165%. In other words, goods that you paid $10,000 for back in 1980 cost you $26,450 today.

http://www.usinflationcalculator.com/

So if you bought your land yacht for $10,000 in 1980 and sold it for 25% more today, you would get $12,500. Unfortunately, to replace it with equivelent goods would cost you over $25,000, considering only inflation. So your asset has experienced a reduction in value of over 50%, or in other words a

depreciation of over 50% in todays dollars.

Sounds like we're around the same age. I also bought a car in 1980. We're a lot alike in that I also do a lot of research, but then I wait till I find what I'm looking for in the condition I want. I had just got out of the Army in 1980, making a big $3,600/year if I recall correctly. I had a little over $9,000 in the bank and HAD to have a cool car. A new Trans Am WS6 Special Edition was $8,600. After some looking I found a like-new 1978 WS6 SE with less than 15K miles being sold for $5,000 by a school teacher that was moving to some island in the Caribbean that I don't recall now. I also bought $3,000 of Lockheed stock after I bought the Trans Am.

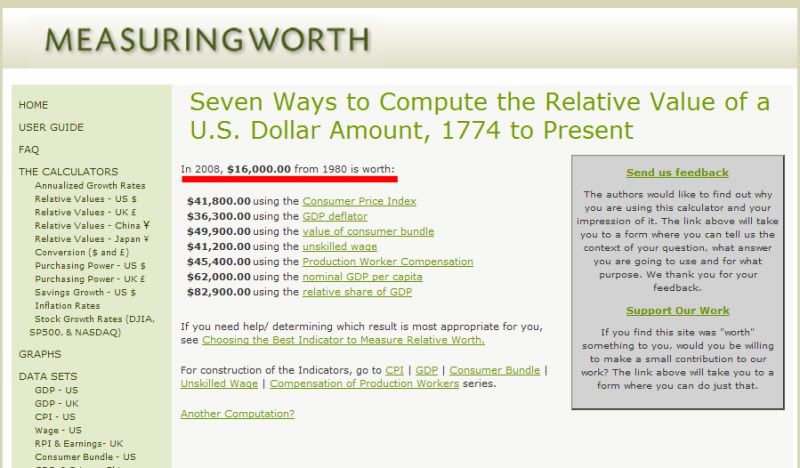

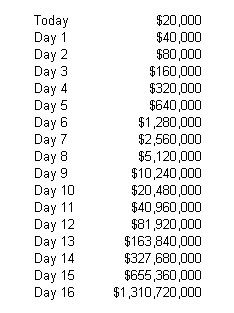

I sold the Trans Am in 1985 for $6,000. I didn't really make $1,000 on it because inflation was running over 10% a year at the time, so money was worth less. Inflation from 1980 to 1985 was 30%. Means I would have had to sell it for $6,500 to get the same amount of purchasing power in 1985 dollars that I had for $5,000 back in 1980. I still have the Lockheed stock (kind of funny because I started working for Martin Marietta in 1985, they merged with Lockheed in 1994 to become Lockheed Martin). The $3,000 in 1980 Lockheed stock was worth a little over $106,000 last week.

My current "land yacht" tow vehicle (pic below) is a 1999 3/4 ton 4WD Suburban that I bought 2 years ago for $3,000. It was a Texas housewife's grocery getter with 67,000 miles on it, looks like new. Tires were almost brand new, still have about 75% tread today. Has leather interior, 3 row seats, front/rear AC, DVD/TV in the roof, etc, etc. They traded it in when it started getting balky about starting. The ignition switch would turn on, but it wouldn't go to the "start" position. I had to jump it across the starter solenoid to test drive it at the dealer's. Definitly helped in the price negotiations! I replaced the $40 ignition switch the day I bought it and it's been perfect since then. An equivelent 2008 Suburban at the time listed for over $43,000.

http://autos.aol.com/cars-Chevrolet-Suburban+2500-2008-LT__4x4/overview/

I prefer my money to work for me, not the car dealer!

Nothing wrong with buying new stuff and keeping it forever if that's what you like. However, in calculating lifecycle costs, take the time value of money into account. Don't try to fool yourself that you're making money on it and aren't suffering depreciation.

It is possible (but extremely rare) to stay ahead of the curve with toys and vehicles if you're lucky. I passed up a Hemi Roadrunner for $700 (almost perfect condition, he wanted to buy a Yamaha RD400) from a friend of mine when I was in the Army. They're going for over $100,000 today ......