Re: Tax Rates! YIKES!!!

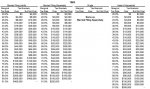

Seriously, as a family making the "middle class" income, why am I now paying 3.3% more in federal taxes than I did over the last few years? My family did not break into the next tax bracket, so the only reason I can come up with is the tax rate table is higher for my income this year than last. I am sure it was all over the TV news that the "middle class" was not going to be hit with tax increases this year.

2006, 2007, 2008 were great tax years compared to 1010.

As a "middle class" American, I have to pay premium prices to get my kids into average colleges, but I make too much for any college funding (other than to take loans). When you take into account that 1/3 of my income is taken in federal and state tax, plus what I pay into health benefits, I get to keep and run my house hold on 2/3 of what I earn. Not to mention the exorbitant real estate taxes we pay here in NJ. Thats another $8000 out the window that I am not including in the 1/3 estimate above. When all is said and done, nearly HALF my "middle class" income goes to taxes. Add in taxes for health insurance, taxes on disability insurance, disability insurance, Social Security, Unemployment insurance and I am sunk.

So if I adjust the W4 to spread $3600 over 26 weeks (my pay periods) that comes to $138 a pay lost to tax increases about every two weeks. About $280 a month.

And you wonder why i own a boat built in 1985 that I work on myself. I would love to have a new boat. Just have to live within my means.

Thank God the price of gas, electricity and food is going down...... Right?